Millennials this year are less likely to be taking creative measures like co-ownership or renting out rooms to afford a mortgage, according to a Redfin survey.

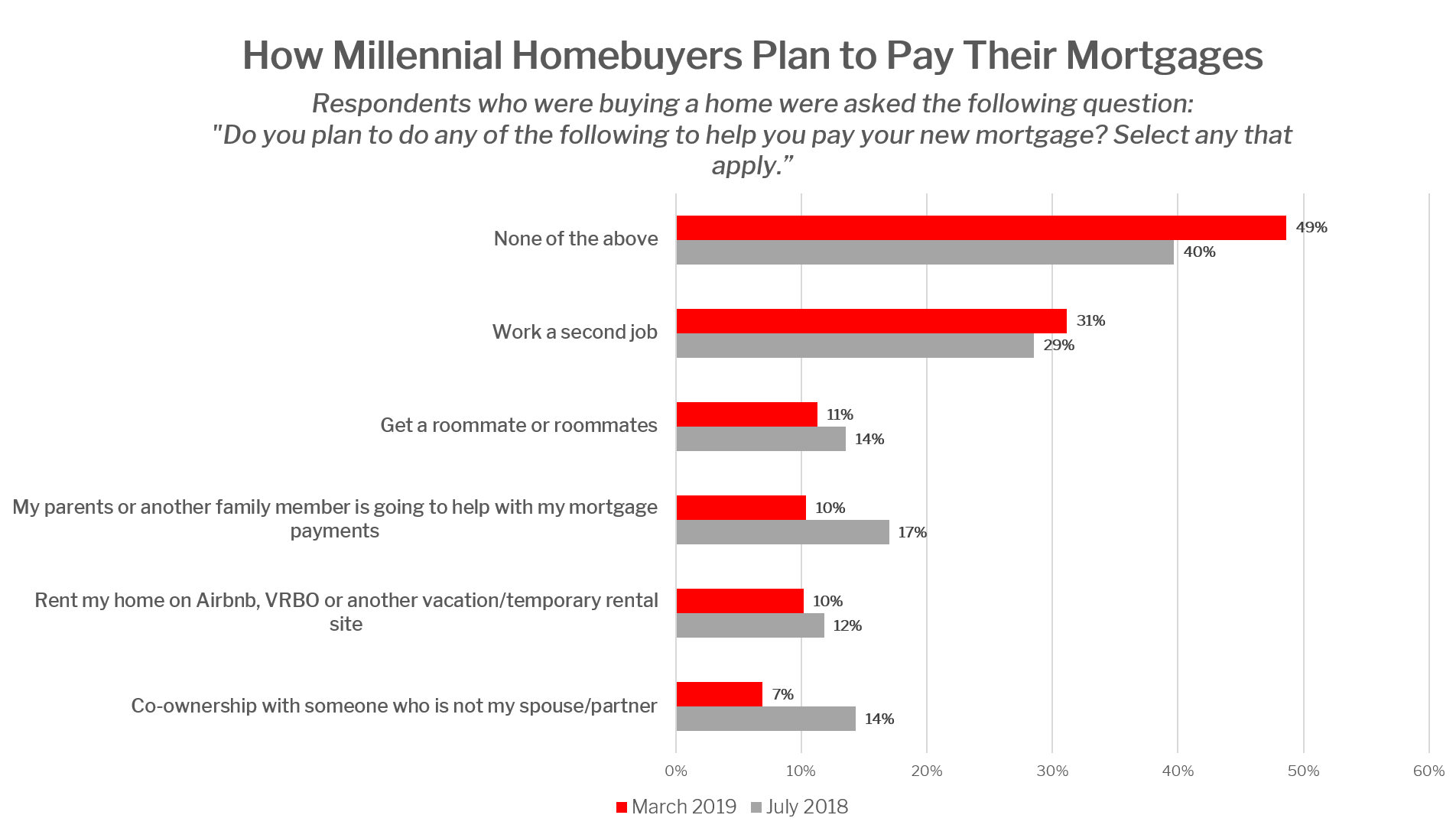

Millennial homebuyers in 2019 are less likely to take extraordinary measures to afford their mortgage payments, such as getting help from their parents or co-ownership with someone other than a spouse or partner, than they were last summer. Fifty-one percent of millennial homebuyers indicated plans to use one or more of these strategies to cover their mortgage payments, down from 60 percent last year.

This is according to a Redfin-commissioned March survey of over 2,000 U.S. residents who planned to buy or sell a primary residence in the next 12 months.

The findings in this report are based on the 1,000 respondents who were born between 1981 and 1996, the generation deemed “millennials.” We compare the results with those from a similar survey we commissioned in July 2018. Both surveys asked all first-time homebuyers the question “Do you plan to do any of the following to help you pay your new mortgage? Select any that apply.” The results presented here are based on the answers that survey respondents selected to that question.

Just 10 percent of millennial homebuyers planned to get help from parents or another family member to make their mortgage payments, down from 17 percent last year.

The share of millennial homebuyers planning on co-owning a home with someone other than their spouse or partner was cut in half, to 7 percent in March from 14 percent last year.

Eleven percent of millennial respondents in March said they planned to get a roommate to help pay their mortgage down from 14 percent in our July 2018 survey. Millennials this year were also less likely this year than last year to say they’d rent out their home on a vacation rental site like Airbnb or VRBO, with just 10 percent planning to do so, down from 12 last year.

“Over the last couple years, millennial household incomes have been rising, and America’s youngest professionals now earn more than previous generations did at this age. As a result, they’re needing less and less help from family members to buy a home,” said Redfin chief economist Daryl Fairweather. “A lot of that increase in millennial household earnings has been driven by millennial women, who are working more and earning more than women of previous generations. Millennials may have postponed getting married, having children and buying a home while they got their careers on track, but now that they are more established in their careers and earning more, I expect to see more millennials buying homes and checking off those major life milestones.”

Thirty-one percent of millennials said they planned to work a second job to pay for their mortgage, up from 29 percent last year. This was the only measure we asked about to see a rise in popularity among millennial respondents.

Source: Redfin.com ~ By