Mortgage rate forecast for next week (Sept. 26-30)

Mortgage rates are up for the fifth week in a row, with the average 30-year fixed rate reaching 6.29% on Sept. 22. This quarter-point growth came on the heels of another big rate hike by the Federal Reserve.

At its recent meeting, the Fed signaled further rate increases in 2022 and 2023 to curb record inflation. Its policies continue to put upward pressure on mortgage rates. That means we could see continued growth in the weeks to come — although mortgage rates are volatile, and there are often dips mixed in. So keep an eye on current rates and lock as soon as you get a quote you’re comfortable with.

Will mortgage rates go down in October?

Mortgage rates fluctuated greatly in the third quarter of 2022. The average 30-year fixed rate dipped as low as 4.99% on Aug. 4 then reached a high-water mark of 6.29% on Sept. 22, according to Freddie Mac.

This followed 248 basis points (2.48%) of growth in the year’s first half. Rates varied from one week to the next as the Fed wrestled with inflation. Mortgage rates experienced the largest weekly jump since 1987, surging 55 basis points (0.55%) the day after the Federal Reserve’s June hike.

With the pandemic’s declining economic impact, decades-high inflation, and the Fed planning several more aggressive hikes, interest rates could continue trending upward this year. However, concerns about an impending recession and waning buyer demand have caused rate drops and could cause more on any given week.

Experts from Attom Data Solutions, CoreLogic, Redfin, and other industry leaders are split on whether 30-year mortgage rates will keep climbing, fall or level off in October.

Nadia Evangelou, senior economist & director of forecasting at the National Association of Realtors

Nadia Evangelou, senior economist & director of forecasting at the National Association of Realtors

Prediction: Rates will moderate

“Three factors mainly affect mortgage rates in today’s market: expectations on inflation, economic growth and the Fed’s next rate hike. Inflation and higher interest rates typically move up yields as investors demand a higher return. Nevertheless, concerns about economic growth can put a hold on the pace of the increase.

In the meantime, the bond market shows signs that there are persistent fears on the economy. Despite having lower risk, the shorter-term bonds continue to have a higher yield than longer-term ones. Thus, I expect the 30-year fixed mortgage rate to hover around 5.9% in October.”

Selma Hepp, deputy chief economist at Corelogic

Selma Hepp, deputy chief economist at Corelogic

Prediction: Rates will fall

“The recent spike in mortgage rates was another reaction to continually strong inflation readings and the expected “large” 75 basis point hike at the September meeting. Nevertheless, after the meeting and into October, we are likely to see mortgage rates return to the 5.5% average as lenders contend with dwindling home buyer demand.”

Joel Kan, associate vice president of industry surveys and forecasts at the Mortgage Bankers Association

Joel Kan, associate vice president of industry surveys and forecasts at the Mortgage Bankers Association

Prediction: Rates will rise

“We expect mortgage rates will remain volatile but elevated as markets continue to grapple with economic uncertainty and tighter monetary policy from the Federal Reserve. However, a strong job market and wage growth offer a slight reprieve and will continue to support housing demand.”

Odeta Kushi, deputy chief economist at First American

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will moderate

“Mortgage rates will likely remain elevated in October but fluctuate on a week-to-week basis. Mortgage rates have steadily increased in recent weeks as financial markets speculated whether or not the Federal Reserve would continue with its aggressive policy to cool inflation.

The August Core Consumer Price Index (CPI) (excluding food and energy) strengthened the case for a more hawkish Fed, as core CPI came in double the expected pace at 0.6%. In response, U.S. Treasury yields increased and mortgage rates alongside them. The surprise to the upside all but guarantees continued aggressive action from the Fed, likely putting more upward pressure on mortgage rates, but at a slower pace, as the Fed’s future tightening is already baked into mortgage rates.”

Taylor Marr, Deputy Chief Economist at Redfin

Taylor Marr, Deputy Chief Economist at Redfin

Prediction: Rates will moderate

“Interest rate movement is very uncertain at this time. Rates will likely have some drops and increases again, depending on the economic data. I could anticipate that a bad data release following a more aggressive path of rates from the Fed would result in renewed recession fears, pulling rates down.”

Rick Sharga, EVP of market intelligence at Attom Data Solutions

Rick Sharga, EVP of market intelligence at Attom Data Solutions

Prediction: Rates will moderate

“Mortgage rate movement in recent months has been as volatile as anything I’ve seen over the past 20 years, and [rates] sometimes appear to jump or drop on a whim. The disappointing most recent inflation report triggered a sharp increase from sub-6% rates to around 6.3%, and could result in the Federal Reserve taking even more aggressive action to try to get inflation under control; this, in turn, could lead to another run-up in mortgage rates.

That said, the market may have already priced in Fed hikes, so hopefully mortgage rates will stabilize in the fall, and move back into the narrow band between 5.5%-6.0% where they spent much of summer.”

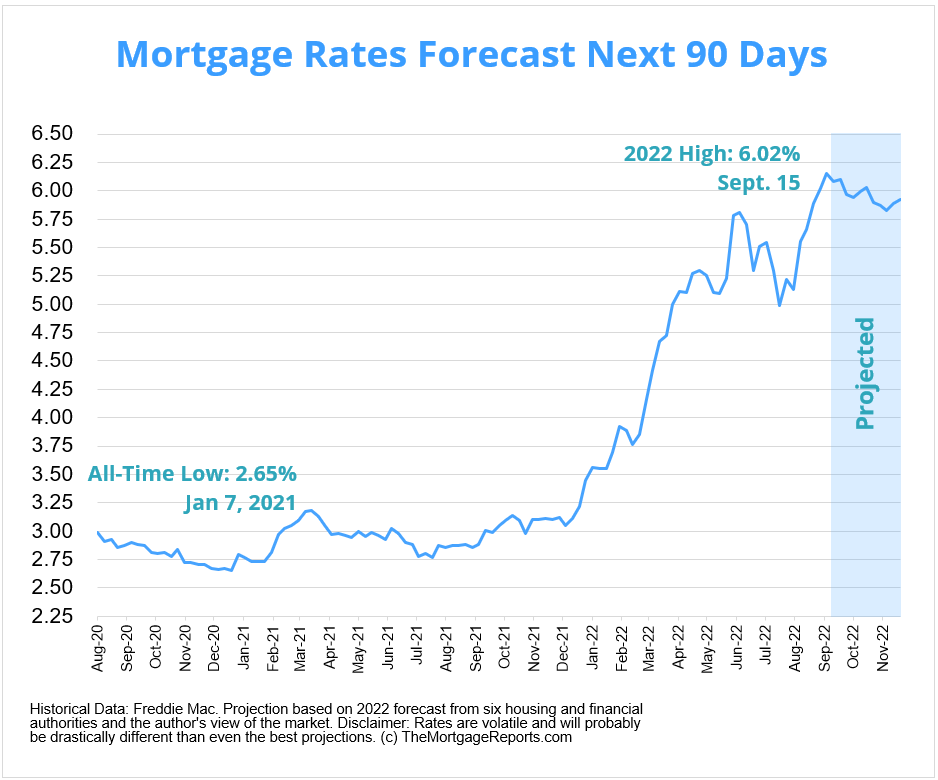

Mortgage interest rates forecast next 90 days

With inflation running high and proving hard to control, the Federal Reserve is following an aggressive policy plan to bring it down. That’s led to an overall ramp-up of interest rates as lenders account for the Fed’s rate hikes.

Because of this, many experts currently believe mortgage interest rates will move within a tighter range in the fourth quarter compared to the large, rapid growth we saw earlier in 2022.

Of course, rate volatility could increase due to the recession’s uncertainty or repercussions of global events impacting the economy.

Mortgage rate predictions for late 2022

The average 30-year fixed-rate mortgage climbed to 6.29% in late September, according to Freddie Mac. All four major housing authorities we looked at project the average for the fourth quarter to finish below that.

Freddie Mac and the Mortgage Bankers Association sit at the low end of the group, estimating the average 30-year fixed interest rate will settle at 5.4% and 5.5% for Q4. Meanwhile, Wells Fargo and the National Association of Realtors had the highest predictions, with forecasts of 5.7% and 6%, respectively, by the end of 2022.

(Fannie Mae and National Association of Home Builders had not released their latest forecasts when this was published and this article will be updated once they do.)

| Housing Authority | 30-Year Mortgage Rate Forecast (Q4 2022) |

| Freddie Mac | 5.40% |

| Mortgage Bankers Association | 5.50% |

| Wells Fargo | 5.70% |

| National Association of Realtors | 6.00% |

| Average Prediction | 5.65% |

Current mortgage interest rate trends

The Federal Reserve’s latest FOMC meeting concluded on Sept. 21 with another 75 basis point (0.75%) increase in the fed funds rate.

Mortgage rates reacted in kind, with the 30-year fixed rate shooting up a quarter point from 6.02% to 6.29% on Sept. 22. Fifteen-year fixed mortgage rates were also up, from 5.21% to 5.44%, while 5/1 ARM rates moved from 4.93% to 4.97%.

Mortgage rates moved on from the record-low territory seen in 2020 and 2021 but are still below average from a historical perspective.

Dating back to April 1971, the fixed 30-year interest rate averaged around 7.8%, according to Freddie Mac. So if you haven’t locked a rate yet, don’t lose too much sleep over it. You can still get a good deal, historically speaking — especially if you’re a borrower with strong credit.

Mortgage rate trends by loan type

Many mortgage shoppers don’t realize there are different types of rates in today’s mortgage market. But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are 3-month mortgage rate trends for the most popular types of home loans: conventional, FHA, VA, and jumbo.

| August 2022 | July 2022 | June 2022 | |

| Conforming Loan Rates | 5.81% | 5.30% | 5.79% |

| FHA Loan Rates | 5.66% | 5.27% | 5.59% |

| VA Loan Rates | 5.45% | 5.00% | 5.34% |

| Jumbo Loan Rates | 5.57% | 5.02% | 5.34% |

Source: Black Knight Originations Market Monitor Report

Which mortgage loan is best?

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high–priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits, which max out at $647,200 in most parts of the U.S.

On the other hand, if you’re a veteran or service member, a VA loan is almost always the right choice. VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance (PMI). But you need an eligible service history to qualify.

Conforming loans and FHA loans (those backed by the Federal Housing Administration) are great low–down–payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620. FHA loans are even more lenient about credit; home buyers can often qualify with a score of 580 or higher, and a less–than–perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates — similar to VA — and reduced mortgage insurance costs. The catch? You need to live in a ‘rural’ area and have moderate or low income to be USDA–eligible.

Find your lowest mortgage rate. Start here (Sep 23rd, 2022)

Mortgage rate strategies for October 2022

Mortgage rates grew fast and furiously to open 2022. The pace slowed in the second quarter, then interest rates shot up after the Fed’s 0.75% federal funds rate hikes in June, July, and September.

The central bank said it anticipates multiple similar hikes throughout 2022 and 2023 until inflation gets under control. Mortgage rates could continue climbing in response. However, opportunities to lock in a lower interest rate do still exist for home buyers and refinancing homeowners.

Here are just a few strategies to keep in mind if you’re mortgage shopping in the coming months.

Consider an ARM

The more interest rates climb this year, the more sense it makes for some borrowers to opt for an adjustable-rate mortgage (ARM).

ARMs tend to get a bad reputation for their association with the housing crash of 2008, but they have better protections in place now and come with certain advantages, like low introductory rates that can be fixed for three to 10 years. There’s also a common misconception that the rate can only increase when it gets adjusted. But because ARMs are market-dependent at the time of adjustment, it’s possible some adjustments could lead to lower rates, too.

Furthermore, ARMs come in different time frames. If borrowers plan to sell or refinance before the next 5 years for example, a 5/1-year ARM would be a great match for them. As of Sept. 15, the rate on a 5/1-year ARM was 4.93% compared to 6.02% for the 30-year fixed rate mortgage, according to Freddie Mac. Borrowers who opt for the ARM in this scenario could save hundreds on their monthly mortgage payments.

Never take the first offer

Since interest rates can vary drastically from day to day and from lender to lender, failing to shop around likely leads to money lost.

Lenders typically have different rates they reserve for different levels of credit scores. And while there are ways to negotiate a lower mortgage rate, the easiest is to get multiple quotes from multiple lenders and leverage them against each other.

“Research has shown that many borrowers only get rate quotes from a single lender,” said Len Kiefer, deputy chief economist at Freddie Mac. “Given the recent volatility in markets, rates can shift substantially day-by-day. A savvy customer would be informed about market conditions and consider multiple options before opting for a lender and loan product that best meets their needs.”

As the mortgage market slows due to lessened demand, lenders will be more eager for business. While missing out on the rock-bottom rates of 2020 and 2021 may sting, there’s always a way to use the market to your advantage.

How to shop for interest rates

Rate shopping doesn’t just mean looking at the lowest rates advertised online because those aren’t available to everyone. Typically, those are offered to borrowers with great credit who can put a down payment of 20% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if buying a home)

- Your home equity (if refinancing)

- Your loan-to-value ratio (LTV)

- Your debt-to-income ratio (DTI)

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a ‘real’ rate quote based on your financial situation.

You should get three to five of these quotes at a minimum, then compare them to find the best offer. Look for the lowest rate, but also pay attention to your annual percentage rate (APR), estimated closing costs, and ‘discount points’ — extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Source: themortgagereports.com ~ By: Paul Centopani ~ Image: Canva Pro