Last year featured a significant amount of uncertainty across the commercial real estate landscape. As market sentiment shifted, investment professionals, in particular, took a more conservative approach, with many sitting on the sidelines waiting for brighter days ahead. While changes were less stark within the management side of the business, no part of the real … Read More “Key Technology Trends for Real Estate in 2024” »

Category: Real Estate Tips

There are whispers in the wind (or headlines in the news) that the housing market might be bouncing back. Here are some indicators that a recovery could be underway: Rising Mortgage Rates Slowdown: Interest rates, which had been climbing steadily, might be plateauing or even dipping slightly. This could make homeownership more affordable for some … Read More “Signs of a Housing Market Recovery” »

Are you ready to become a master in the art of home selling? Whether you’re a seasoned pro or a first-time seller, there’s always room to improve your skills and achieve even greater success. Selling your home can be a daunting task, but with the right mindset and a willingness to learn, you can take … Read More “8 Highly Effective Habits and Tips for a Home Seller” »

When you hear “curb appeal,” you imagine a perfectly manicured lawn bordered by colorful perennial flowers. But if you’re selling your home when the snow arrives, lush landscaping isn’t an option. You’ll need to get creative with your winter curb appeal to give buyers a cheerful first impression. And trust us, winter curb appeal is … Read More “12 Winter Curb Appeal Ideas That Shine Through Snow, Sleet, and Rain” »

If you make energy improvements to your home, tax credits are available for a portion of qualifying expenses. The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022. We’ll help you compare the credits and decide whether they apply to expenses you’ve already paid or will apply to … Read More “Home Energy Tax Credits” »

Do you know the common winter home selling mistakes? Selling your home in winter presents a unique set of challenges. There are still buyers out there, which means there is a good chance you can sell your home for a great price. But to do so, you will need to avoid the most common mistakes … Read More “Winter Home Selling Mistakes to Avoid” »

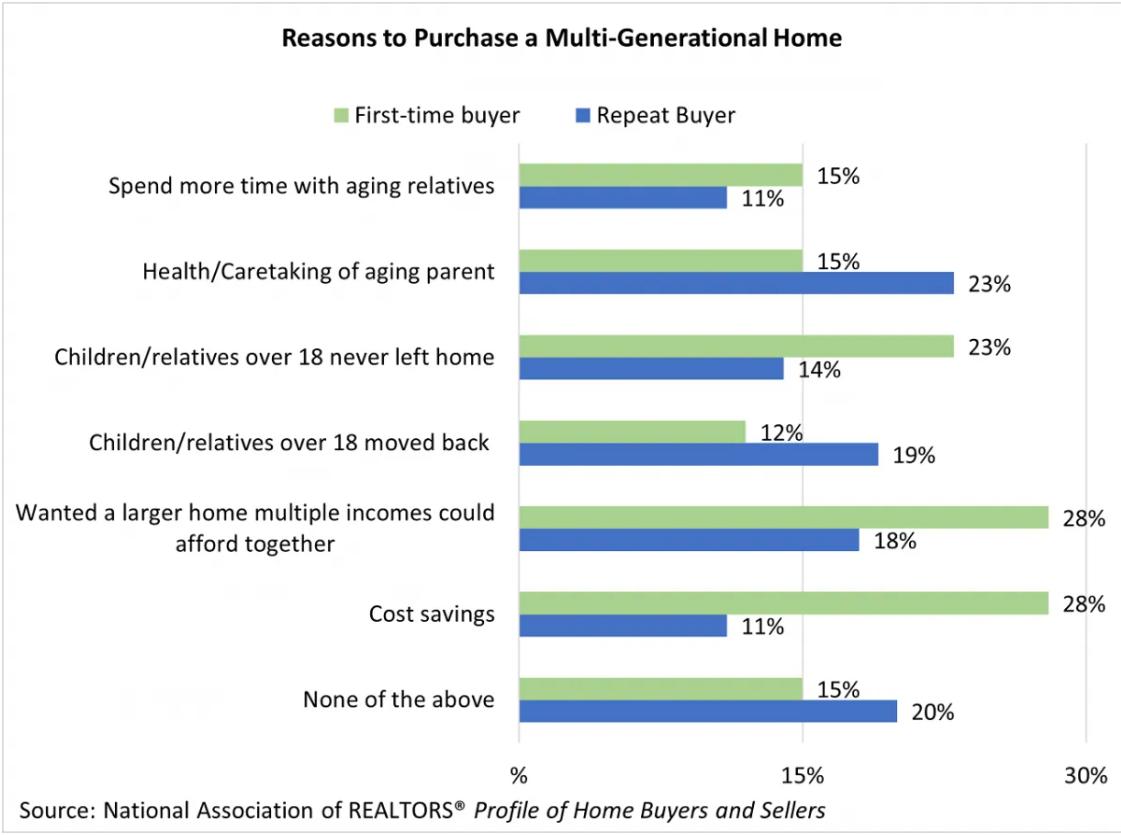

Multi-generational home buying is a way for families to care for one another, support one another, and often buy a home that may have been previously out of reach. Multi-generational buying may be a home where families live in the same home with elderly parents, children who have boomeranged back home, or other extended family … Read More “All in the Family: Multi-Generational Home Buying” »

Buying has almost always been favored over renting when it comes to housing. For some, renting is considered “throwing money away” while buying is an “investment.” The truth is, the answer to the rent-versus-buy question is much more nuanced than this “one size fits all” approach. It’s more like “which size fits me?” That is … Read More “Should you rent or buy? Before you decide, ask yourself some questions” »

If spring is the best time of year to give your home a thorough cleaning, then fall is the best time to tackle home improvement projects. Not only does the cooler weather force us inside more often, but it’s also the perfect season to finish things up before a long winter. 11 Home Improvement Ideas … Read More “Fall Home Improvement Projects” »

…One Real Estate Agent Has Ever Heard They say your home is the biggest investment you’ll ever make. At the heart of that investment, though, is your mortgage. What seems like a simple concept at face value—a loan granted for buying property—is actually much more complicated. That’s why you’ll hear experts in finance and real … Read More “The 5 Best Pieces of Mortgage Advice…” »