- The average 30-year fixed mortgage rate increased for the third consecutive week to 3.63%

- Rates are now at levels not seen since April 2020 — nearly two years ago

- This week’s increase is the biggest weekly increase since March 2020: Rising by 23 basis points over last week

- This week’s increase aligns with the rising rates many experts have long predicted in 2022

- Federal Reserve Chairman Jerome Powell recently announced the Fed would begin winding down measures to support the economy during the pandemic, which is also likely to contribute to rising rates

- Inflation is the highest it’s been in 40 years, according to the latest data released by the Bureau of Labor and Statistics (BLS) — it’s a key driver of rising rates, experts say

- This week’s increase contradicts speculation that surging COVID-19 cases and the Omicron variant might cause rates to decrease or remain flat

- Despite the increase, mortgage rates are still significantly lower than prepandemic levels

The average 30-year fixed mortgage rate jumped up again this week, to 3.63% — the highest it’s been since April 2020.

This week’s jump — rising by 23 basis points — is the largest weekly increase in nearly 2 years. It’s also the third week in a row that rates increased. The rising rates can be partly attributed to a recent surge in inflation, experts say, which new data shows hit a 40-year high in December.

Despite the potential for surging COVID cases amid the current Omicron wave to put a damper on economic growth, this week’s increase is consistent with recent statements by Federal Reserve Chairman Jerome Powell that the Fed expects to raise rates three times in 2022. As the Fed increases rates with the economy improving, mortgage and refinance rates are sure to follow, experts say.

The December 2021 consumer price index released by the Bureau of Labor and Statistics (BLS) suggests more rate increases should be expected as long as inflation continues. The 7% inflation in the last 12 months is the largest inflation surge in 40 years, and is cited by experts and the Fed as a major factor behind rising rates.

Many experts predicted mortgage rates would reach this level in 2022, but they didn’t expect it to happen this quickly. Redfin chief economist Daryl Fairweather recently told us she thought rates would reach 3.6% by the end of 2022. “My expectation for when mortgage rates will increase is spread pretty evenly throughout the year,” said Fairweather.

Even if rates continue to inch upward, stay the same, or decrease, what’s important for homebuyers and homeowners isn’t where rates are headed, but making sure a refinance or home purchase is the right financial move for their circumstances.

Here’s a look at what to expect and what this means for borrowers.

ABOUT THE LATEST MORTGAGE RATES

Last week’s average mortgage rate is based on mortgage rate information provided by national lenders to Bankrate.com, which like NextAdvisor is owned by Red Ventures.

2022 Mortgage Rates and the Housing Market: What to Expect

Rising rates like we’ve seen the last few weeks are likely to continue, experts say.

The average 30-year fixed mortgage rate will hit 4% by the end of 2022, says Joel Kan, an economist at the Mortgage Bankers Association’s (MBA). Kan cites expected economic growth in 2022 as one of the biggest reasons behind his prediction.

While some experts have said new economic uncertainty brought on by the Omicron wave could stall rising rates, that hasn’t been the case so far. A new wave of COVID variants threatens economic progress, putting downward pressure on mortgage interest rates, Zillow economist Nicole Bachaud, recently told us.

The economy is better prepared to handle new waves of rising COVID cases than it was during the pandemic’s early days, says Logan Mohtashami, HousingWire data analyst. New COVID variants and surges in cases haven’t had as much of a negative impact on the economy as the initial wave, so even while the pandemic continues, rates will likely continue increasing, he says.

If you look at the Delta variant, “economic growth continued relatively smoothly,” Realtor.com chief economist Danielle Hale told us recently. New variants will have a smaller impact on actual economic activity, she said.

The majority of consumers share experts’ sentiments. According to a recent Fannie Mae housing study, 56% of Americans believe mortgage rates will increase over the next 12 months.

While 3.63% may not look as attractive as the sub-3% rates we saw in early 2021, rates are still very low from a historical perspective — and still at attractive refinancing levels. They remain significantly lower than the nearly 4% levels they were at prior to the pandemic. What matters most is how much you can lower your current rate. If you can lower your current rate by close to 75 basis points, you can stand to benefit from a refinance — translating to significant savings in interest paid over the life of the loan.

For prospective homebuyers, we believe the housing market is starting to cool down. But demand is expected to stay high, Kan recently told us. “We have a lot of younger people in the population entering, or who are already at, the prime homeownership age,” Kan says.

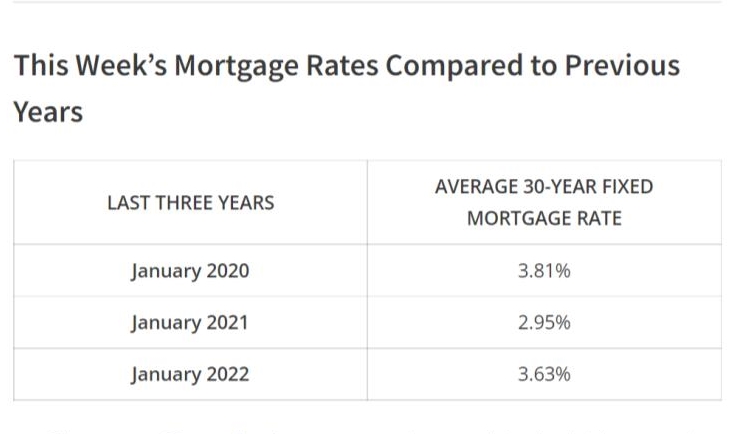

This Week’s Mortgage Rates Compared to Previous Years

| LAST THREE YEARS | AVERAGE 30-YEAR FIXED MORTGAGE RATE |

|---|---|

| January 2020 | 3.81% |

| January 2021 | 2.95% |

| January 2022 | 3.63% |

Mortgage rates bottomed out a year ago when they reached record lows below 3%. That is almost a half of a percent lower than where mortgage rates are today. But two years ago, the average 30-year fixed mortgage rate was at 3.81% — significantly higher than today’s rates.

The big drop in rates in 2021 was largely a result of the economic effects of the COVID-19 pandemic and the Federal Reserve’s reactive policies to support the economy. Nearly 9 million workers reported losing employment in 2020, according to the U.S. Bureau of Labor Statistics (BLS). In an effort to avoid widespread foreclosures, the Federal Reserve implemented policies intended to drive down interest rates to make housing more affordable. Lower interest rates can help keep homebuying affordable and encourage homeowners to refinance to lower monthly mortgage payments.

What Other Mortgage Industry Data Is Saying

This week’s big rate increase was also evident in the latest Freddie Mac survey, a long-running mortgage rate average watched by industry experts. The Freddie Mac survey had the average 30-year mortgage rate average at 3.45% this week, an increase of 23 basis points over its previous week average. This is the largest weekly Freddie Mac increase since March 2020.

Freddie Mac is a government-sponsored organization that purchases home loans on the secondary market. Its survey methodology and the time period in which it collects data each week differs from other surveys, such as the Bankrate survey referenced throughout this article. While different mortgage rate averages will show slight variation, they do show similar overall mortgage rate trends over time.

PRO TIPS

Existing Homeowners:

- Rising mortgage rates might make it seem like refinancing is no longer a good option, but that’s not necessarily true. Mortgage rates at current levels are still considered favorable compared to the 4%+ rage they were prepandemic. A good rule of thumb is if you can score a new mortgage rate that is close to 0.75% lower than your current rate, it could be a good move to refinance.

- Homeowners who are on the fence about refinancing may want to consider it. Mortgage rates are expected to continue their upward trajectory in the long term, so it may be worth crunching the numbers with a few lenders to see if you can benefit.

- A rate and term refinance could go a long way in reducing not only your monthly payments but also the amount of interest paid over the life of the loan. With home values across the country having increased over the past year, you could also take advantage of the increased equity in your home by doing a cash-out refinance. A cash-out refi can be a useful tool to help pay off high-interest debt, pay for college expenses, or fund a home improvement project.

New Homebuyers

- Save for a down payment of at least 10%, but ideally 20%. With housing prices having increased over the past year, you might need a larger down payment to stay within an affordable range. While a low mortgage rate can help offset down payment expenses, a large home loan can overshadow the potential savings from a low mortgage rate.

- Most experts say not to time the market and buy when the time is right for your personal situation. If you’ve been sitting on the sidelines hoping prices will drop, you may be disappointed, Glen Brunker, president of Ally Home, recently told us. Since home price appreciation is forecasted to grow, timing the market is not a recommended strategy, he said.

- Plan Ahead:

- Knowing how much house you can afford

- Don’t rush into a home purchase

- Sticking to a homebuying budget

- Finding an experienced real estate agent you’re comfortable with

- Plug and play your estimated figures into NextAdvisor’s mortgage calculator to see what your monthly payment may look like.

Source: time.com ~ By: ~ Image: